Mehedi Hasan

Published:2021-12-01 22:41:32 BdST

Private credit growth exceeds 9pc after a year

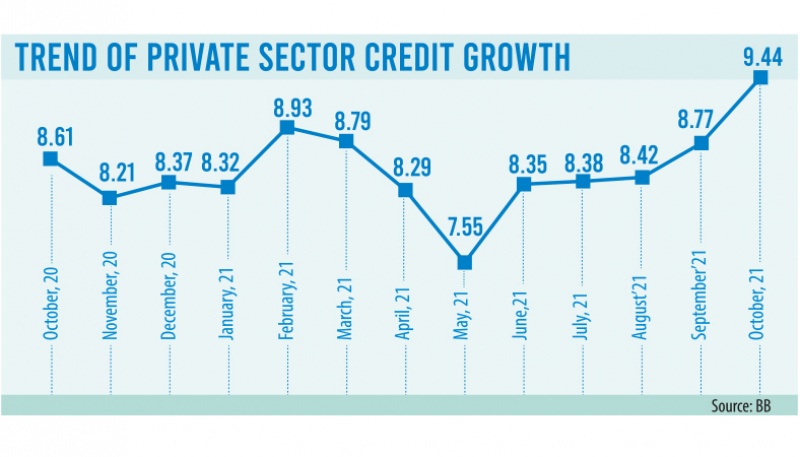

Bangladesh’s private sector credit growth has surpassed the 9 percent mark this October after a year, as the country’s economy gradually returned to the pre-pandemic level from stagnation triggered by the Covid-19 pandemic.

The year-on-year private sector credit growth reached 9.44 percent in October, up from 8.77 percent in September this year, according to latest data from the Bangladesh Bank. This figure previously crossed 9 percent in September 2020 – hitting 9.48 percent.

Commenting on the matter, Dhaka Bank’s Managing Director and CEO Emranul Huq said, “The credit demand is on the rise due to the country’s reopening economy, which is going back to the pre-pandemic level. We are optimistic that the trend will continue in the coming days.

“Dhaka Bank’s credit growth had stagnated for almost 17 to 18 months amid the pandemic, but our credit growth is growing on par with this sector.”

The credit growth of October is 5.36 percentage points lower than the Bangladesh Bank’s target for the current fiscal year. The central bank kept the private sector credit growth target unchanged at 14.8 percent for the FY2021-22.

The lenders refrained from disbursing credit during the countrywide shutdown from March 26 to May 30 last year, which dropped the credit growth to 8.6 percent in June 2020, from 9.2 percent in January the same year.

The credit growth then hovered around 8 percent for the next several months. Moreover, the banking sector’s surplus liquidity increased sharply in 2020 due to the slow credit demand.

In December last year, surplus liquidity surpassed Tk2 lakh crore, the central bank data says, adding that the figure rose to a record high Tk 2,31,711 crore in June 2021.

Private sector credit growth had fallen to 7.55 percent in May this year due to the second wave of the pandemic, and then it started rising from June 2021. The surplus liquidity is now falling as the credit demand is on the rise and import payments increased, an analysis of the data shows.

Surplus funds in the banking industry stood at Tk 2,19,600 crore in September this year, down from Tk 2,31,221 crore in August, the central bank data shows.

Responding to a query, Pubali Bank’s Managing Director Saiful Alam Khan Chowdhury said, “The bank is receiving a large volume of credit proposals from businesses after the country’s economy began reopening.

Pubali Bank‘s credit rose 13 percent in the ten months of this year, its managing director said, adding that the credit demand will increase further in the coming days.

“However, there is an uncertainty in the upcoming months because a new variant of the novel coronavirus has hit in many countries,” said Chowdhury.

Echoing the same, NRB Bank’s Managing Director Mamoon Mahmood Shah said, “The credit demand has increased as the country’s economy returned to normal.”

Till October this year, total outstanding loans in the private sector stood at Tk 12,19,536.8 crore, says the central bank data.

Unauthorized use or reproduction of The Finance Today content for commercial purposes is strictly prohibited.