03/04/2026

Banking sector reform can’t be done quickly: Salehuddin

Staff Correspondent | Published: 2026-01-22 22:41:53

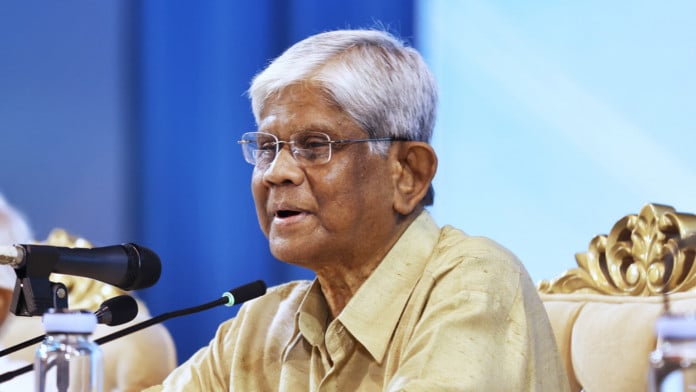

The country’s banking sector remains under severe structural stress and meaningful reform cannot be achieved within a short time frame, Finance Adviser Salehuddin Ahmed said on Thursday.

“The banking sector is definitely challenging. Institutions have been weakened, laws are often ignored and in many cases owners themselves control management, bypassing prudential norms,” he said.

Finance Adviser Salehuddin Ahmed said this while speaking at MTB-FE Roundtable on “Banking sector reforms” at a city hotel.

The adviser said the challenges facing the sector are deep, complex and institutionalised and the problems accumulated over the past 15 years cannot be fixed in 14 to 16 months.

He said Bangladesh Bank has operational autonomy but full independence is neither realistic nor desirable without accountability.

“No central bank can operate beyond the sovereignty of the state. Autonomy must go hand in hand with accountability,” he added.

Referring to international assessments, the adviser cited recent global reports highlighting illicit financial flows, crime-related trade and inflation as key vulnerabilities for countries like Bangladesh.

He said these issues directly affect the stability of the banking system and must be addressed primarily by the central bank with support from the finance ministry.

The adviser also criticised the role of auditors, alleging that some chartered accounting firms had signed audit reports without proper verification.

“This is an absurd reality. Auditors signing backdated or questionable reports severely undermine financial discipline,” he said adding that some firms have already been blacklisted.

Irregularities are not limited to banks alone, mentioning that large financial activities in some sectors, including higher education often escape proper auditing, he added.

The adviser said the government has recently passed amendments to the Negotiable Instruments Act and the House Building Finance Corporation Act, while work on amendments to money laundering laws and economic courts is ongoing.

However, time constraints remain a major challenge, he said adding that “We have very limited time left but we are trying to complete as much as possible."

The adviser acknowledged concerns over excessive numbers of senior officials at Bangladesh Bank and said steps have already been taken to rationalise the structure.

Despite the challenges, he said Bangladesh’s international image remains relatively positive.

“Externally, the perception is not that Bangladesh is collapsing. But partners do say the situation is difficult,” he noted.

The adviser said banking sector reform is unavoidable and critical for the economy.

“This opportunity should not be wasted. If we cannot complete all reforms now, the next government must carry them forward. The banking sector is too important to delay,” he said.

Bangladesh Bank Governor Ahsan H Mansur was present as the special guest while Professor of the Bangladesh Institute of Bank Management Shah Md Ahsan Habib delivered the keynote speech.

Editor & Publisher : Md. Motiur Rahman

Pritam-Zaman Tower, Level 03, Suite No: 401/A, 37/2 Bir Protik Gazi Dastagir Road, Purana Palton, Dhaka-1000

Cell : (+88) 01706 666 716, (+88) 01711 145 898, Phone: +88 02-41051180-81